are political contributions tax deductible irs

A state or United States possession or political subdivision thereof or the United States or the District of Columbia if made exclusively for public purposes. Individuals cannot deduct contributions made to political campaigns on their federal tax returns regardless of whether they itemize or claim the standard deduction.

Why Political Contributions Are Not Tax Deductible

A political organization is subject to tax on its political organization taxable income.

. You cant deduct contributions made to a political candidate a campaign committee or a newsletter fund. Are Political Donations Tax Deductible. How much of political contributions are tax-deductible.

You may deduct a charitable contribution made to or for the use of any of the following organizations that otherwise are qualified under section 170c of the Internal Revenue Code. Campaign committees for candidates for federal state or local office. You can generally deduct cash securities and property donated to qualified charitable or 501c3 organizations on your federal income tax return.

Given that political donations arent tax deductible its important to familiarize yourself with IRS rules regarding the deductibility of charitable contributions. Political Contributions Are Tax Deductible Like. The IRS is very clear that money contributed to a politician or political party cant be deducted from your taxes.

This means that if you donate to a political candidate a political party a campaign committee or a political action committee PAC these contributions will not be tax-deductible. For you and your family. If the organization is the principal campaign committee of a candidate for US.

Note that even though political donations are not tax deductible the IRS still limits how much money you can contribute for political purposes. Political contributions are not tax deductible though. Congress the tax is calculated.

And political action committees are all political organizations under IRC 527. If youre unsure about whether a donation you have made is considered political or not use the IRS Tax-Exempt Organization Search Tool to see if the organization you donated to is classified as a 501c3 organization. Among other requirements most tax-exempt political organizations have a requirement to file periodic reports on Form 8872 with the IRS.

Today a former Indianapolis-based casino executive pleaded guilty to causing the casino company to make false statements on its federal tax return by concealing contributions to a local political party as. Nondeductible Lobbying and Political Expenditures. Though giving money to your candidate of choice is a great way to get involved in civic discourse donations to political candidates are not tax-deductible.

Participating or intervening in any political campaign on behalf of or in opposition to any candidate for public office. If an individual donates property other than cash to a qualified organization the individual may generally deduct the fair market value of the. In 2022 an individual may donate up to 2900 to a candidate committee in any one federal election up to 5000 to a PAC annually up to 10000 to a local or district party committee annually and up to 35000 to a national party.

If youre planning to donate money time or effort to a political campaign you might be thinking to yourself Are political contributions tax-deductible No. The IRS which has clear rules about what is and is not tax-deductible notes that any contributions donations or payments to political organizations are not tax-deductible. Political contributions deductible status is a myth.

Generally this tax is calculated by multiplying the political organization taxable income by the highest rate of tax specified in 11 b. And political donations cannot be treated the same way as tax deductible contributions. The IRS makes it clear that you cannot deduct contributions that you make to any organizations that arent qualified to receive tax-deductible donations.

April 18 2022 Two men have pleaded guilty to federal crimes for their roles in paying and receiving secret political contributions through a middleman. Advertisements in convention bulletins and admissions to dinners or programs that benefit a political party or political candidate arent deductible. This doesnt just mean that donations made to candidates and campaigns are excluded from being tax deductible.

While political contributions arent tax-deductible many citizens still donate money time and effort to political campaigns and to. In 2022 an individual may donate up to 2900 to a candidate committee in any one federal election up to 5000 to a PAC annually up to 10000 to a local or district party committee annually and up to 35000 to a national party. Note that even though political donations are not tax deductible the IRS still limits how much money you can contribute for political purposes.

A lot of people assume that political contributions are tax deductible like some other donations. Nondeductible lobbying and political expenditures are described in Code section 162 e and include expenditures paid or incurred in connection with. Contributions must actually be paid in cash or other property before the close of an individuals tax year to be deductible for that tax year whether the individual uses the cash or accrual method.

Are Political Contributions Tax Deductible H R Block

Are Political Contributions Tax Deductible Anedot

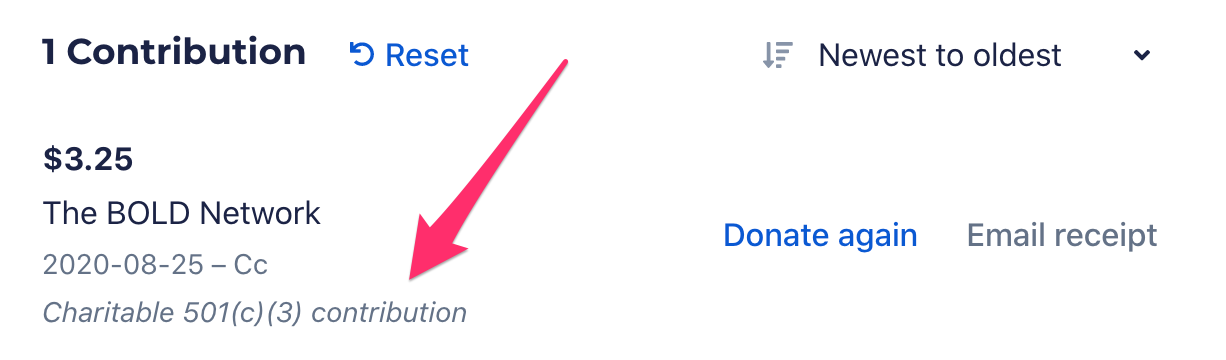

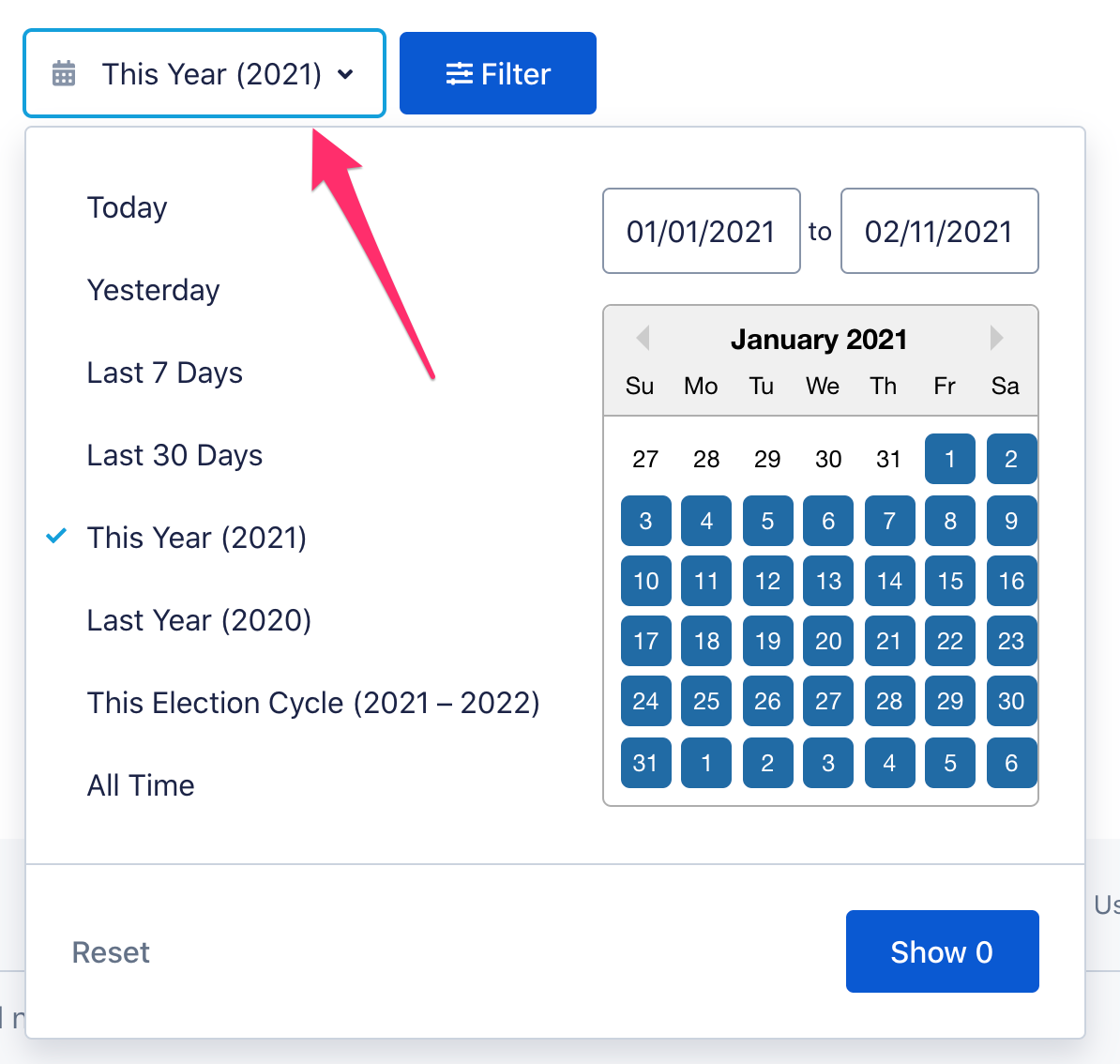

Are My Donations Tax Deductible Actblue Support

Deductions For Donations Your Guide To Tracking Charitable Contributions Quicken Loans

Are Political Contributions Tax Deductible Personal Capital

Are Political Contributions Tax Deductible Tax Breaks Explained

Are Political Contributions Tax Deductible Taxact Blog

Why Political Contributions Are Not Tax Deductible

Are Political Donations Tax Deductible Credit Karma Tax

Are Campaign Contributions Tax Deductible

Charitable Deductions On Your Tax Return Cash And Gifts

Are My Donations Tax Deductible Actblue Support

Why Political Contributions Are Not Tax Deductible

Are Political Contributions Tax Deductible H R Block

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos

Are My Donations Tax Deductible Actblue Support

Are Contributions To A Political Organization Tax Deductible Universal Cpa Review

Write Offs For The Self Employed For All The Visual Learners Out There This Board Is For You We Ve C Rowing Workout Rowing Machine Workout Machine Workout

Explore Our Image Of In Kind Donation Receipt Template Receipt Template Donation Letter Template Teacher Resume Template